|

|   |

International Creditor Invoicing is when you receive a International Creditor Invoice from an overseas supplier and you have to make sure setup your International Creditor & the Import Creditor are setup correctly, then create the Creditor Invoice with the Import Costing details. This is a 3 Step process as follows;

Step 1: Checking or creating your suppliers are setup correctly.

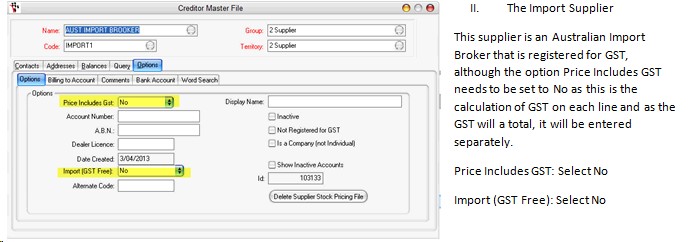

Generally on an International Invoice you will have been invoiced by 2 Creditors � The International Supplier who you purchased the stock from AND the Importer you pay the freight and GST charges too. The suppliers should be setup in the Creditor Master File as follows;

Step 2. Entering the International Supplier Invoice details

I Select the International Creditor you Created. Select Yes to the GST Prompt

II. Enter the Reference (Invoice Number), Reference Date and the Invoice Amount = the International Suppliers Total (NOT including the additional Import Costs, simple the Total of the Part Items on the Invoice)

III. Select the Part items and if the Unit Prices are shown on the invoice as a different currency, you can click the Options button and select Use Currency Conversion and Enter the current conversion rate.

Step 3. The Import Supplier Invoice Details

II. Select OK and Process to Finalise your Invoice

Where does it all process to?

The International Invoice - The total of details entered in in Step 2 are in the Creditor Master File awaiting Creditor Payment

The Import Supplier Invoice - The total of details entered in in Step 3 are in the Creditor Master File awaiting Creditor Payment AND the additional costs are added to the Part items (as the Landing cost reflects the total line plus all additional freight charges therefore being the actual total cost of the part)

The GST - The total of GST charges details entered in in Step 3 are in the General Ledger Account �GST Paid� awaiting GL Processing.

There is a full article on the above process which may be more up to date available here http://service.autosoft.com.au/entries/21508725-International-Import-Creditor-Invoicing-Freight-Options-GST-on-Freight-and-Creditor-General-Ledger-P