|

|   |

A journal is a Entry Directly into the GL Accounts. The general journal is where double entry bookkeeping entries are recorded by debiting one or more accounts and crediting another one or more accounts with the same total amount. The total amount debited and the total amount credited should always be equal, thereby ensuring the accounting equation is maintained. These are used for a number of reasons, primarily to record transactions which are not associated to an invoice.

Header Areas

Description - When carrying out a Journal an entry must be made in Description at the top of the journal screen.

Notes - are used merely as a description so can be whatever the user wants.

Entered date - will always be the current date when the journal is being entered

Posted date Is the date you want the system to reference the journal for reporting and querying purposes.

GL Lines Entry

Note: Account numbers shown in the examples are samples only, check your General Ledger accounts for your actual GL codes.

Ac>> F4 to Select or Enter the GL Account Number you need to either debit or Credit then Tab

GL Account>> Will display the Name of the GL Account you have selected

Department Will show the GL Department

Franchise For Franchises Only - Will show the Franchise code if the GL you have selected is only available for a specific GL.

Control # Simply tab through this section as the GLs selected will have their Control # preset and it does not need to be entered again.

Debit/Credit Enter the Amount you wish to debit or Credit in the applicable column. Keep an eye out for the red text hints at the bottom which will guide you whether the Debit will increase or decrease dependant upon the GL Account you selected.

Stock #> For Dealerships Only - F4 to Select or Enter the Vehicle Stock Number if you are doing a Journal to a Vehicle Stock GL

Cost Type For Dealerships Only - Use the drop down to select what Cost Type your Journal is for.

GST Type Select the GST Type as applicable for your journal entry. NOTE: you can do an entry straight to the GST Collected or Paid GLs if the amounts are separate entries and not the normal division of 10%.

Account >> If you have chosen the Trade Debtors or Creditors Account, you will have to select the specific Debtor/Creditor Account the amount is for.

Payee When you do a Journal to the Cash in Bank account (1020) for a Credit, the Payee name can be entered.

Chq# Enter the specific Cheque number the journal is for if applicable. Important Note: When the Cash in Bank account (1020) is Credited the Payee and Cheque Number must be entered (from your Cheque book) by pressing Tab across the screen to the payee and Cheque number. This is important as the Cheque numbers will get out of sequence if this is not done.

Branch For Branches Only - as GLs are consistent across the Branches, enter the Branch ID will populate based on the branch you logged into Autosoft under. If the Journal is for a differing branch, log out and log into that branch before continuing your journal.

Buttons & Options

Abort Allows you to exit without saving your Journal Entry.

Post Finalises the Journal and will only be available if your Total Debits match your total Credits.

Change Post Date Allows you to Change the Post date of a Posted Journal.

Standing Journal Are Template Journals that you can setup for Journal entries you use regularly. These can be setup in the Standing Journals program.

Change GL Account Allows you to change the GL you have selected if the journal is still Open, saving you having to delete the whole line and reenter all the values.

Copy Journal Allows you to Copy a Posted Journal.

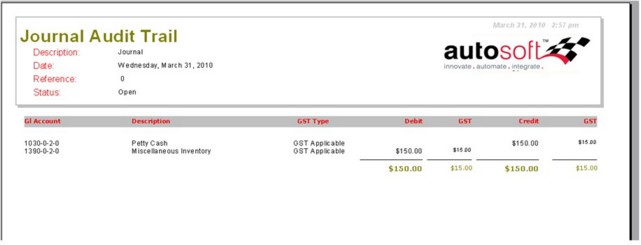

Print Audit trail- Run Report Allows you to run an Audit Trail report directly from the Journal screen to give you a summary report on the different entries on the journal.

GL Item Notes An extra Notes field for the transaction.

|

What were you trying to do? |

Video/Knowledge base guide |

|

Do a Journal |

http://service.autosoft.com.au/entries/21692749-How-to-Do-a-Journal- |

|

Journal says GL Account will not allow Journals |

http://service.autosoft.com.au/entries/21791504-Allowing-Journals-to-GL-Control-Accounts |

|

Setup Pre Filled Journals for Frequent use |

|

|

Enter your Opening Balances of your GL Accounts |

|

|

Learn more about GL Accounts, Journals, Standing Journals and Maintenance |

Go to your Client Portal Login - Training Lessons - General Ledger Series - General Ledger Basics Part 2

|

When a transaction is carried out in Autosoft various accounts in the General Ledger are updated. The general ledger accounts can be updated either manually through a Journal or automatically by; invoicing, paying creditors, receiving debtor receipts etc.

Below are samples of typical journal entries.

|

A Debtor Receipt has been entered twice by mistake, to reverse the entry carry out the following |

||||

|

GL Code |

Description |

Debit |

Credit |

Comments |

|

1100 |

Debtor Account |

$100.00 |

|

Select the Debtor at the Debtor/Creditor>> field. |

|

102o |

Bank Account |

|

$100.00 |

|

|

When you process the journal above leave payee and Cheque number BLANK. |

||||

|

To carry out a reversal of a Creditor Payment entered twice carry out the following |

||||

|

GL Code |

Description |

Debit |

Credit |

Comments |

|

1020 |

Bank Account |

$100.00 |

|

|

|

2000 |

Creditor Account |

|

$100.00 |

Select the Creditor at the Debtor/Creditor>> field |

Below are examples of how transactions are updated:

Debtor Receipt

|

Below are examples of two debtor receipts, one includes settlement discount given |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1100 |

Debtors - Trade and Vehicle |

|

500.00 |

|

1020 |

Cash at call |

500.00 |

|

|

The GL Accounts above have distributed the values by: reduced the amount in the Debtors account by $500.00 (balance sheet), added $500.00 to Cash at Call (balance sheet). |

|||

Debtor Receipt with Settlement Discount Given

|

Settlement discount of $50.00 was given to this debtor |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1100 |

Debtors - Trade and Vehicle |

|

550.00 |

|

2050 |

GST Collected |

4.55 |

|

|

5330 |

Net Discounts |

45.45 |

|

|

1020 |

Cash at call |

500.00 |

|

|

The GL Accounts above have distributed the values by: reduced the amount in the Debtors account by $550.00 (balance sheet), reduced GST Collected by $4.55 (balance sheet), increased Discounts by $45.45 (Profit & Loss), added $500.00 to Cash at Call - Cheque Account (balance sheet). Note: Settlement Discount Given is basically a credit to a customer. |

|||

Creditor Payment

|

This is a normal creditor payment of $250.00 |

|||

|

GL Code |

Description |

Debit |

Credit |

|

2000 |

Creditors - Trade |

250.00 |

|

|

1020 |

Cash at call |

|

250.00 |

|

The GL Accounts above have distributed the values by: reduced the amount in the Creditor account by $250.00 (balance sheet), reduced Cash at Call by $250.00 (balance sheet). |

|||

Creditor Payment with Settlement Discount Taken

|

Below is a creditor payment with Settlement Discount Taken of $20.00 |

|||

|

GL Code |

Description |

Debit |

Credit |

|

2000 |

Creditors - Trade |

320.00 |

|

|

1200 |

GST Paid |

|

1.82 |

|

5330 |

Net Discounts |

|

18.18 |

|

1020 |

Cash at call |

|

300.00 |

|

The GL Accounts above have distributed the values by: reduced the amount in the Creditor account by $320.00 (balance sheet), reduced GST Paid by $1.82 (balance sheet), increased Net Discounts by $18.18 (Profit & Loss), reduced Cash at Call by $300.00 (balance sheet). |

|||

NOTE: The setup of separate Discounts Paid and Discounts Received GL accounts are up to the preference of the user and their Accounting advice. For this example, one Net Discounts (Expenses) account is being used (GL Account 5330), but a 3000-level account as a Discounts Taken GL Account and a 5000-level account as a Discounts Given GL Account is an acceptable way to divide these discounts accounts for separate reporting.

Manual Cheque Payments

|

Manual Cheque payment for an electricity account |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1200 |

GST Paid |

24.50 |

|

|

1020 |

Cash at call |

|

269.50 |

|

5290 |

Light & Power |

245.00 |

|

|

The GL Accounts above have distributed the values by: increase the amount in the GST Paid account by $24.50 (balance sheet), reduced Cash at Call by $269.50 (balance sheet), increase the amount in Light & Power by $245.00 (Profit & Loss). |

|||

Parts Invoice

|

This is a parts invoice to a debtor. The invoice amount of $275 includes freight and GST |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1100 |

Debtors - Trade and Vehicle |

275.00 |

|

|

2050 |

GST Collected |

|

25.00 |

|

1300 |

Parts Inventory Control |

|

153.59 |

|

3740 |

Sales - Parts Counter |

|

200.00 |

|

4740 |

C.O.S Parts Counter |

153.59 |

|

|

3780 |

Freight Income |

|

50.00 |

|

The GL Accounts above have distributed the values by: increasing the amount in the Debtors account by $275.00 (balance sheet), added $25.00 to GST Collected (balance sheet), reduced the Parts Inventory by $153.59 (balance sheet), added $200.00 to Sales Parts (Profit & Loss), added $153.39 to C.O.S. Parts (Profit & Loss), added $50.00 to Freight Income (Profit & Loss). Note: If the invoice above was a cash sale the only change would be that account 1100-Service & Parts Debtors would be 9999-Bank Undeposited Funds. |

|||

Workshop Invoice

|

Below are the dissections for a workshop invoice for a debtor. The invoice of $230.00 has parts and sublet repairs |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1100 |

Debtors - Trade and Vehicle |

230.00 |

|

|

4630 |

C.O.S Other |

.01 |

|

|

2050 |

GST Collected |

|

20.91 |

|

3630 |

Sales Service - Other |

|

89.10 |

|

4630 |

C.O.S. Service - Other |

76.00 |

|

|

1380 |

Sublet Repairs Inventory |

|

76.00 |

|

1300 |

Parts Inventory Control |

|

86.36 |

|

3740 |

Sales - Parts Counter |

|

120.00 |

|

4740 |

C.O.S. - Parts Counter |

86.36 |

|

|

The GL Accounts above have distributed the values by: increasing the amount in the Debtors account by $230.00 (balance sheet), reduced the C.O.S Other account by .01 for Rounding (Profit & Loss), added $20.91 to GST Collected (balance sheet), added $89.10 to Sales Service - Other, for the Sublet Repairs (Profit & Loss), added $76.00 to C.O.S. Service - Other, for the Sublet (Profit & Loss), reduced the Sublet Repairs Inventory by $76.00 (balance sheet), reduced the Parts Inventory by $86.36 (balance sheet), added $120.00 to Sales Parts (Profit & Loss), added $86.36 to C.O.S. Parts (Profit & Loss). |

|||

NOTE: In the Workshop Invoice, various Sales, C.O.S and Inventory Accounts can be used depending on the sales-types that are setup in the Workshop Sale Types.

Car Sales GL Interaction

Below is outlined the interaction with the general ledger when a process is performed in the Car Sales areas of Autosoft. Each example uses Autosoft's standard GL chart of accounts.

1. Vehicle Acquisition

|

Used Car Vehicle Acquisition |

|||

|

GL Code |

Description |

Debit |

Credit |

|

1260 |

Stock - Used Cars |

10,000.00 |

|

|

1200 |

GST Paid |

1000.00 |

|

|

2000 |

Creditors - Trade |

|

11,000.00 |

|

GST implications: Tax credit $1,000. |

|||

|

New vehicle acquired from manufacturer and placed on floor plan |

||||

|

GL Code |

Description |

Debit |

Credit |

Comment |

|

1250 |

Stock - New Cars |

10,000.00 |

|

Increase Inventory |

|

1205 |

GST Floorplan Pending |

1000.00 |

|

GST claim is made when the floor plan is paid out |

|

2310 |

Floorplan Loan Account |

|

11,000.00 |

|

|

GST implications: none. $1, 000 will be available as tax credit when floor plan is paid out. |

||||

|

Note: If an amount is entered into Warranty Provision and the option "Use Warranty Provision" is ticked in the system file, then the following will be updated in addition to those listed above: |

|||

|

GL Code |

Description |

Debit |

Credit |

|

2260 |

Provision for Warranty |

|

500.00 |

|

4450 |

C.O.S Warranty Expenses |

500.00 |

|

2. Allocation of Costs to Vehicle

A cost can be to a vehicle by either:

When a cost is allocated to a vehicle, the system will check to make sure that the General Ledger account you have entered is the correct account. The account will be different based upon whether the vehicle is in stock or the vehicle is sold. If the account is incorrect, the prompt that will appear will be similar to: "The account selected is not the vehicle asset account. Change this account to the vehicle asset account?".

Costs for a vehicle in stock

|

Example cost: allocating a Green Slip for $310 for a vehicle in stock. Note that Green Slips, Rego Cost and Other GST Free costs - are all GST free. |

||||

|

GL Code |

Description |

Debit |

Credit |

Comment |

|

2000 |

Creditors - Trade |

|

310.00 |

|

|

1260 |

Stock - Used Cars |

310.00 |

|

Vehicle inventory account as set-up in the vehicle Group File |

|

GST implications: None. GST Free - will appear on BAS as GST Free Supplies. |

||||

|

Example Cost: fitting 2 tyre's $275 for a vehicle that has been sold. |

||||

|

GL Code |

Description |

Debit |

Credit |

Comment |

|

2000 |

Creditor |

|

275.00 |

|

|

4510 |

C.O.S. New Vehicles |

250.00 |

|

Cost of sales account as set-up in the vehicle Group File. |

|

1200 |

GST Paid |

25.00 |

|

|

|

GST implications:Tax credit $25 |

||||

3. Sell Vehicle

|

Description |

Value |

|

Sold Vehicle for |

13,990.00 |

|

Vehicle Purchase cost (including GST) |

11,000.00 |

|

Reconditioning Costs (Tyre's Panel Beating) |

385.00 |

|

Trade In Allowance |

5500.00 |

|

Overall owing on Trade-In |

1000.00 |

|

Finance Company Payout |

4000.00 |

|

Sell Vehicle |

||||

|

GL Code |

Description |

Debit |

Credit |

Comment |

|

3540 |

Sales - Used Vehicles |

|

12,718.19 |

Sale of vehicle (less GST) |

|

1110 |

Vehicle Debtors |

12,490.00 |

|

Changeover price. ($13,990 less $5,500 trade-in plus $4000 Payout). |

|

4510 |

C.O.S. New Vehicles |

350.00 |

|

Reconditioning costs allocated to vehicle while in stock. |

|

1250 |

New Vehicle Inventory |

|

350.00 |

Reconditioning costs allocated to vehicle while in stock. |

|

4540 |

C.O.S. Used Vehicles |

10,000.00 |

|

|

|

1260 |

Stock - Used Vehicles |

|

10,000.00 |

|

|

2050 |

GST Collected |

|

1271.81 |

GST on purchase price, 1/11 of $13,990 |

|

1260 |

Stock - Used Cars |

4000.00 |

|

Value of trade in (exclusive of GST and over allowance). |

|

4420 |

C.O.S. Vehicle Over allowance |

1000.00 |

|

|

|

2070 |

Payout Pending on Vehicles |

|

4000.00 |

|

|

2050-1 |

GST Pending on trade-in's |

500.00 |

|

Holding account for GST collected n trade-in, claimable when the traded vehicle is sold. |

|

GST implication: Tax owing $1271.81. $500 available when traded vehicle is sold. |

||||

The traded vehicle above was wholesaled at cost.

|

The following General Ledger accounts are updated: |

||||

|

GL Code |

Description |

Debit |

Credit |

Comments |

|

3540 |

Sales - Used Vehicles |

|

5000.00 |

Sale of vehicle (less GST.) |

|

1100 |

Trade & Vehicle Debtors |

5500.00 |

|

Wholesale company owes this amount. |

|

4540 |

C.O.S. Used Vehicle |

4000.00 |

|

Purchase price of vehicle (less over allowance). |

|

1260 |

Stock - Used Vehicles |

1000.00 |

|

Value of over allowance |

|

1260 |

Stock - Used Vehicles |

|

5000.00 |

|

|

2050 |

GST Collected |

|

500.00 |

GST collected on sale of vehicle. |

|

2050-1 |

GST Pending on trade-in's |

|

500.00 |

Reverse GST pending when the vehicle was traded. |

|

1200 |

GST Paid |

500.00 |

|

Claim GST from when the vehicle was originally traded. |

|

GST implication: None. (Tax owing of $500 from sale of vehicle. Tax credit of $500 from when vehicle was originally traded). |

||||

4. Floor plan

Add vehicle to floor plan.

|

Vehicle purchased for $8,800. Total value floor planned 1 week after acquisition. |

||||

|

GL Code |

Description |

Debit |

Credit |

Comments |

|

218 |

Accrued Floor plan |

|

8800.00 |

Floor plan owing account |

|

1020 |

Bank Account |

8800.00 |

|

Finance company pays you the value of floor plan. |

|

2050 |

GST Collected |

|

800.00 |

The GST paid when the vehicle was acquired is reversed. (i.e. cannot claim GST at this time). |

|

2040 |

Floor plan GST Pending |

800.00 |

|

The GST paid is placed in a holding account until the floor plan is paid out. |

|

GST implication: None. $800 will be available as tax credit when floor plan is paid out. |

||||

Pay Vehicle Floor plan

After the vehicle is sold, the floor plan needs to be paid out.

|

The following accounts are updated: |

||||

|

GL Code |

Description |

Debit |

Credit |

Comments |

|

2180 |

Accrued Floor plan |

8800.00 |

|

Floor plan owing account |

|

1020 |

Bank Account |

|

8800.00 |

Cheque is drawn to the finance company. |

|

1200 |

GST Paid |

800.00 |

|

The GST paid can be claimed now that the floor plan is paid out. |

|

2040 |

Floor plan GST Pending |

|

800.00 |

The holding account is credited. |

|

GST implication: Tax credit $800 |

||||

General ledger codes used in the above examples are taken from Autosoft's standard set of GL account codes. Your GL account codes could be different to those represented above.

To check account dissections from a transaction; find the transaction number i.e. invoice number, at General Ledger Reports choose Transaction Report, select Individual Transaction, type the Reference number and run.

|

What were you trying to do? |

Video/Knowledge base guide |

|

Do a Journal |

http://service.autosoft.com.au/entries/21692749-How-to-Do-a-Journal- |

|

Allow Journals to specific GLs |

http://service.autosoft.com.au/entries/21791504-Allowing-Journals-to-GL-Control-Accounts |

|

Reverse a Journal |

http://service.autosoft.com.au/entries/21422709-How-to-Reverse-Out-a-Journal-Entry |